tax abatement nyc meaning

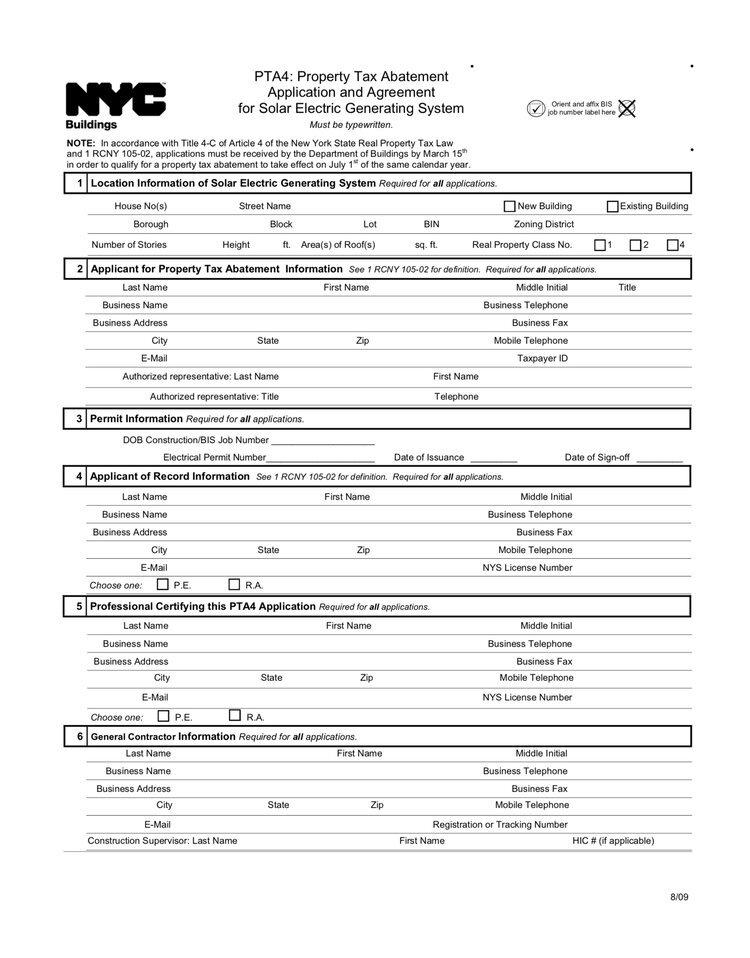

If you are a co-op shareholder or condo unit owner you should tell your board or managing agent if the unit is your primary residence so that you can receive the abatement. These include the J-51 Program the 421a Program the Senior Citizen Rent Increase Exemption SCRIE the.

What Is The 421g Tax Abatement In Nyc Hauseit Tax Lower Manhattan Meant To Be

Homebuyers can understand the true meaning of the abatement by knowing when it will expire.

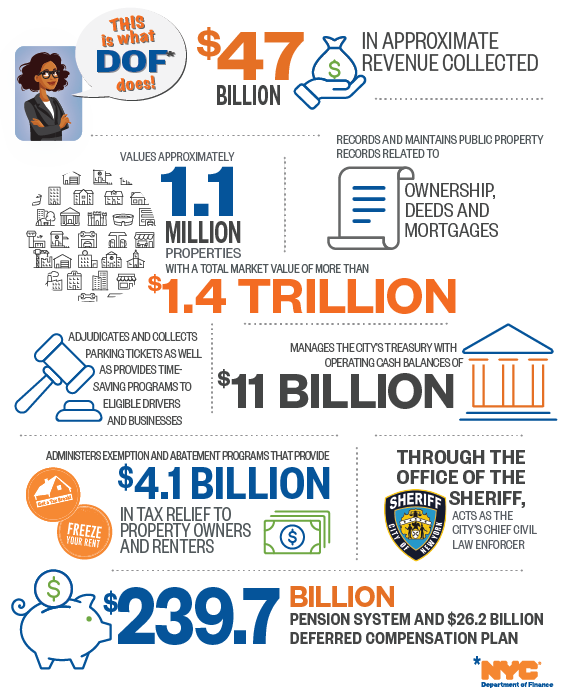

. Like many you must have wondered what 421a tax abatement is. The Idea to give tax exemption was floated in 1971 to court. New York City has several tax abatement programs in place.

Individual unit owners cant apply for the co-op or condo abatement directly. The more recent development on 421a tax abatement is aimed at affordable housing. More details can also be found in HCR Fact Sheet 41.

Taxpayers should understand the difference between tax abatement and tax penalty abatement to avoid confusion. To determine the beginning and end dates for tax benefits given to a building for either of these two programs visit the NYC Department of Finance J-51 Exemption and Abatement and 421-a Exemption webpages. To give you a general idea the tax exemption was framed to encourage property developers to build new residential real estate in NYC.

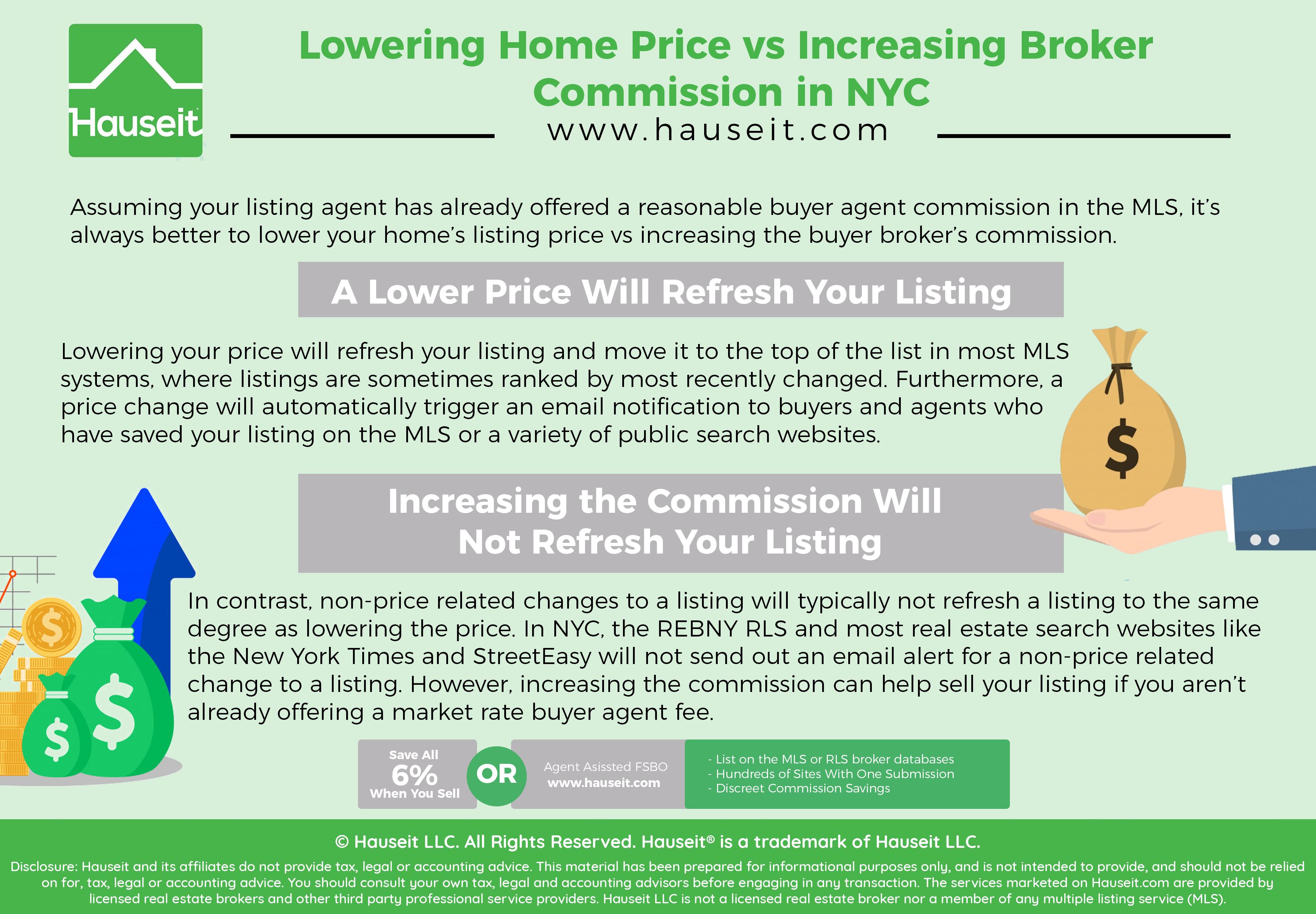

It also decreases your property tax on a dollar for dollar basis. The end of the 421a housing-construction abatement means that the states property tax laws must be reformed. While 421a tax abatements get all the attention there are actually many other types offered by NYC.

To be eligible industrial and commercial buildings must be built modernized expanded or otherwise physically improved. A co-op tax abatement assessment allows a co-op to raise additional revenue for ongoing building operations and capital improvements by capturing tax abatement or tax. May 30 2022 622pm.

You may notice that some of the programs listed have aspects of both an abatement and exemption. While such tax NYC benefits apply to. New condominium owners must have filed a real property transfer tax RPTT.

Pros and Cons of 421a Tax Abatements You might think that having lower taxes is just 100 winning. 2 days agoThe pain at the pump is very real right now but New York is trying to ease that pain a bit through the end of the year. Pros of 421a Tax Abatements for NYC Home Buyers.

That means your tax bill will go up which can be an unpleasant surprise. But there can be some drawbacks. New York NY 10038.

The 421-a abatement was initially set to run for 10 years but can run for as long as 15-25 years in upper Manhattan and the outer NYC boroughs. This program provides abatements for property taxes for periods of up to 25 years. The most common abatements discussed by apartment buyers are 421a 421g J-51 and the co-op and condo tax abatement.

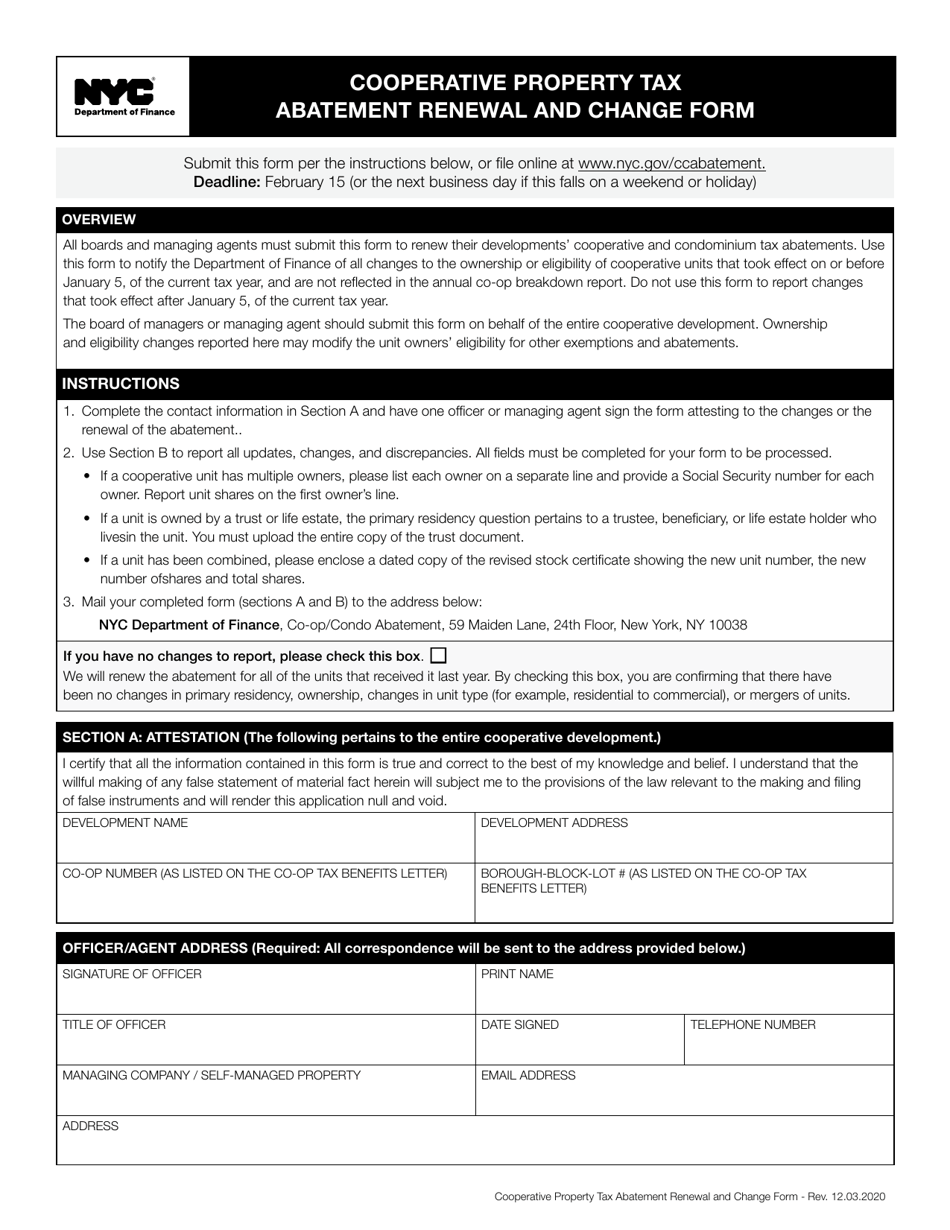

A J-51 abatement is a form of tax exemption that freezes the assessed value of your structure at the level before you started construction. Also available is a list of all NYC Tax Incentive Programs. Co-op and condo boards and managing agents must notify the Department of Finance of changes in ownership or eligibility for the Cooperative and Condominium Property Tax Abatement by February 15 or the following business day if February 15 falls on a weekend or holiday.

Overall J-51 tax abatements reduce the assessed taxable value of your property while reducing the actual property tax on a dollar to dollar. The 10-year abatement provides unit owners with a 100 abatement from property tax increases for the first two years with taxes then being increased by 20 of the current tax rate every two years for. The exemption also applies to buildings that add new residential units.

Here is a list of many of the various types of real estate tax abatement and exemption programs within New York City. For those who want to see New York. What Is The 421g Tax Abatement In Nyc Hauseit Perhaps the most well-known is the 421a abatement which recently expired but gave developers and.

Starting Wednesday the states gas tax will be suspended meaning drivers. The 2022-2023 renewal period has ended. Simply put you get a tax break for the duration of the abatement says Golkin.

Information you may find helpful in filing your. A break on a building or apartments property taxes. The 421a tax abatement is a tax bill granted to property developers and focuses on affordable housing in densely populated areas of New York.

For example if an owner has a 20-year tax abatement they. Tax abatement nyc meaning.

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Tax Abatement Nyc Guide 421a J 51 And More

How Much Is The Coop Condo Tax Abatement In Nyc

How To Calculate The Unabated Property Taxes On A Nyc Condo With A 421a Tax Abatement Youtube

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

How Much Is The Coop Condo Tax Abatement In Nyc

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Tax Abatement Nyc Guide 421a J 51 And More

What Is The 421g Tax Abatement In Nyc Hauseit Tax Lower Manhattan Meant To Be

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

What Is The 421g Tax Abatement In Nyc Hauseit Tax Lower Manhattan Meant To Be

New York City Cooperative Property Tax Abatement Renewal And Change Form Download Fillable Pdf Templateroller

Cheapest Ways To Sell A House Hauseit Things To Sell Selling Strategies Selling House

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

What Is A 421a Tax Abatement In Nyc Streeteasy